At a recent hearing before the Subcommittee on Oversight of the Committee on Ways and Means, I was asked a seemingly simple question about what types of guidance taxpayers can rely on. Unfortunately, the answer is not simple at all. … Read More

Monthly Archives: July 2017

TAS assistance offered at local Problem Solving Days

The Taxpayer Advocate Service (TAS) will conduct Problem Solving Day events in communities throughout the country in the coming months and year. During these events, TAS employees from a local office will be available to assist taxpayers in … Read More

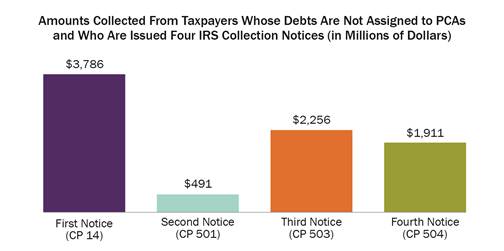

Private Debt Collection: Recent Debts (Part 3 of 3)

In an earlier blog I discussed my concern about how the IRS’s private debt collection (PDC) program affects taxpayers who are likely experiencing economic hardship. In this blog, I want to share my concern that the IRS is not making good … Read More

Success Story: TAS Advocates for Return of Levied Proceeds

Every year the Taxpayer Advocate Service (TAS) helps thousands of people with tax problems. This story is only one of many examples of how TAS helps resolve taxpayer issues. All personal details are removed to protect the privacy of the … Read More

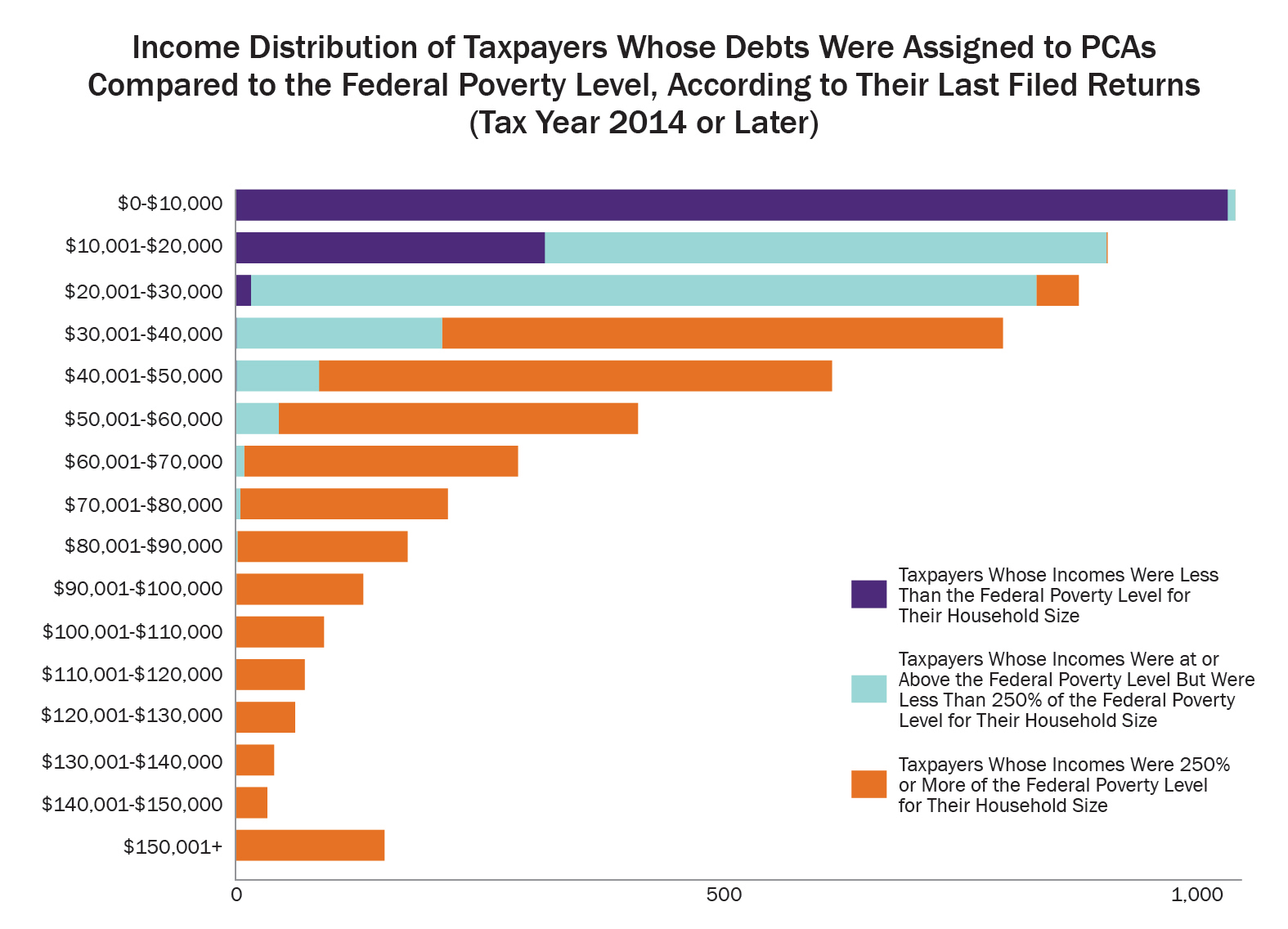

Private Debt Collection: Hardship (Part 2 of 3)

I have always had concerns about outsourcing tax debts to private collection agencies (PCAs). First, I believe tax collection is an “inherently governmental function” within the meaning of section five of the 1998 FEAR Act that should be performed only by … Read More

Success story: Victim of Preparer Fraud Receives Refund

Every year the Taxpayer Advocate Service (TAS) helps thousands of people with tax problems. This story is only one of many examples of how TAS helps resolve taxpayer issues. All personal details are removed to protect the privacy of the … Read More

Private Debt Collection Program

Since 2004, when Internal Revenue Code (IRC) § 6306 was enacted as part of the American Jobs Creation Act, the IRS has had the statutory authority to outsource the collection of tax debt. The IRS exercised this authority in its … Read More