Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog. As we wrap up this year with putting … Read More

Monthly Archives: December 2018

TAS Tax Tip: Deduction and Expense Changes; Gear-up now for changes that will affect your 2018 return

It’s the holidays and is anyone really thinking about taxes? We hope you are, because there are certain things you will want to know now, and some you may need to act upon before the end of the calendar year. … Read More

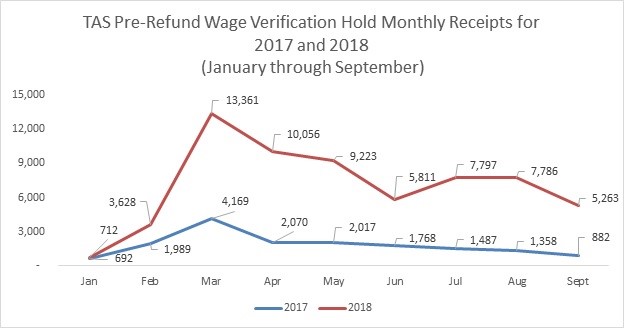

NTA Blog: IRS Fraud Detection: A Process That is Challenging for Taxpayers to Navigate with an Outdated Case Management System Resulting in Significant Delays of Legitimate Refunds Part 2

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog. In last week’s blog, I discussed issues that … Read More

TAS Tax Tip: Families – Gear-up now for changes that will affect your 2018 return

It’s the holidays and is anyone really thinking about taxes? We hope you are, because there are certain things you will need to know now, and some you may need to act upon before the end of the calendar year. … Read More

NTA Blog: IRS Fraud Detection – A Process That is Challenging for Taxpayers to Navigate with an Outdated Case Management System Resulting in Significant Delays of Legitimate Refunds Part 1

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog. As we approach the filing season, I thought … Read More

Know how getting married changes your tax situation

When you get married, your tax situation changes. Your marital status as of Dec. 31 determines your tax filing options for the entire year. If you’re married at year-end, you have two filing status choices: filing jointly with your new … Read More