Each year the IRS sponsors the Nationwide Tax Forums, a three-day series of tax education and networking conferences for tax professionals in cities around the country. These events feature the latest information from the IRS, news about tax law changes, … Read More

Monthly Archives: April 2019

NTA Blog: The Second Circuit in Borenstein Helped to Close the Gap in the Tax Court's Refund Jurisdiction, but Only for Taxpayers in that Circuit

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog In 2017, the U.S. Tax Court decided the … Read More

TAS Tax Tip: Updates to Estimated Tax Penalty Waiver

The April 15th tax deadline has passed, however the IRS announced on March 22, 2019 that it is expanding the waiver of the Estimated Tax Penalty to include relief for taxpayers whose total withholding and estimated tax payments equal or … Read More

Tax Notes podcast features an interview with the National Taxpayer Advocate

On April 11, National Taxpayer Advocate (NTA) Nina Olson sat down with a senior reporter from Tax Notes, an online publication for tax professionals, to record an interview about the filing season and other tax issues. In part one of … Read More

TAS Tax Tips for Tax Pros: Earned Income Credit Tools and Information

Earned Income Tax Credit (EITC) rules are complex and helping clients claim this and other refundable credits is sometimes a challenge. That is especially true while performing the Due Diligence steps needed for returns you prepare and advising clients under … Read More

TAS Tax Tip: Payment and Penalty Relief Options

Tax time can be especially tough if taxes are owed with your tax return and even harder if penalties and interest are charged. Our website’s Get Help pages have a wealth of information about various payment options and will guide … Read More

NTA Blog: The Adoption of a Withholding Code and the Improvement of Free File Fillable Forms Would Streamline Tax Withholding and Reporting

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog In last week’s blog, I discussed the potential … Read More

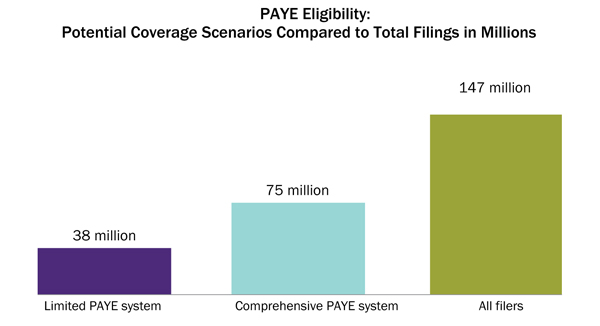

NTA Blog: Expanding Pay-As-You-Earn Tax Collection Could Bring Significant Benefits

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog Imagine it’s tax filing season. You’re dreading figuring … Read More

TAS Tax Tip: Correcting tax returns, if you made a mistake or forgot to file

If you make a mistake on your taxes, do you know what to do and how to correct the mistake? There are many options on how to fix a mistake on your tax return, depending on whether you received a … Read More

NTA Blog: The IRS Should Redesign Its Notices Using Psychological, Cognitive, and Behavioral Science Insights to Protect Taxpayer Rights, Enhance Taxpayer Understanding, and Reduce Taxpayer Burden

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog With the filing season in full operation, many … Read More