Taxpayers who claimed the additional standard deduction for the blind on their Form 1040 or Form 1040-SR tax return within the last two tax years should have received IRS Letter 9000 EN-SP, Alternative Media Preference Election, between September 15 and … Read More

Monthly Archives: October 2021

TAS Tax Tip: Got married? Here are some tax ramifications to consider and actions to take now

Did you get married this year or plan to marry before Dec. 31st? If yes, read on… When you get married, your tax situation changes. Your marital status as of Dec. 31 determines your tax filing options for the entire … Read More

TAS Tax Tip: IRS provides answers to custody situations that affect Advance Child Tax Credit payments

Custody Situations for Advance Child Tax Credit Payments Parents who share custody of their children should be aware of how advance child tax credit (CTC) payments are distributed. This information could help you avoid a possible tax bill when filing … Read More

NTA Blog: The IRS and Private Collection Agencies: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers?

October 13, 2021 NTA Blog: The IRS and Private Collection Agencies: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers? Background on IRS’s Private Collection Agencies In December 2015, Congress required the … Read More

TAS Tax Tip: I got a notice or letter from the IRS – now what do I do?

Extension of Time to File Most taxpayers who requested an extension of time to file for their 2020 federal income tax return will have until Friday, October 15, 2021, to file. Although October 15 is the last day for most … Read More

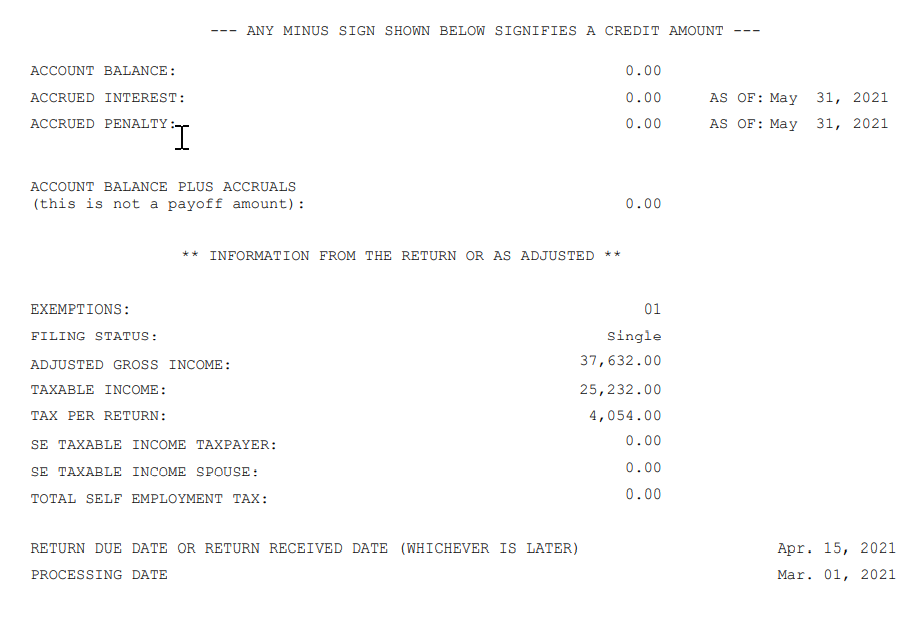

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part II

<!– Español –> Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Part I explained how transcripts are often used to validate income and tax … Read More

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part I

<!– Español –> Decoding IRS Transcripts and the New Transcript Format: Part I Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Transcripts are often … Read More