August 29, 2023 – Some penalties require supervisory approval before they can be assessed by the IRS. The applicable statute, however, is vague regarding the point at which this approval must occur. This statutory ambiguity has generated conflicting decisions among … Read More

Monthly Archives: August 2023

NTA Blog: Where’s My Refund? Has Your Tax Return Been Flagged for Possible Identity Theft (IDT)?

August 22, 2023 – One persistent challenge the IRS continually deals with is preventing fraudulent refunds from being issued. Sadly, this phenomenon has become more and more common, as the number of refundable credits and their values continue to increase, … Read More

TAS Tax Tip: The IRS Launches Paperless Processing Initiative

August 31, 2023 – Starting in 2024, you can begin communicating with the IRS digitally; additional enhancements coming in 2025. The IRS announced that taxpayers will have the option to go paperless for IRS correspondence by the 2024 filing season, … Read More

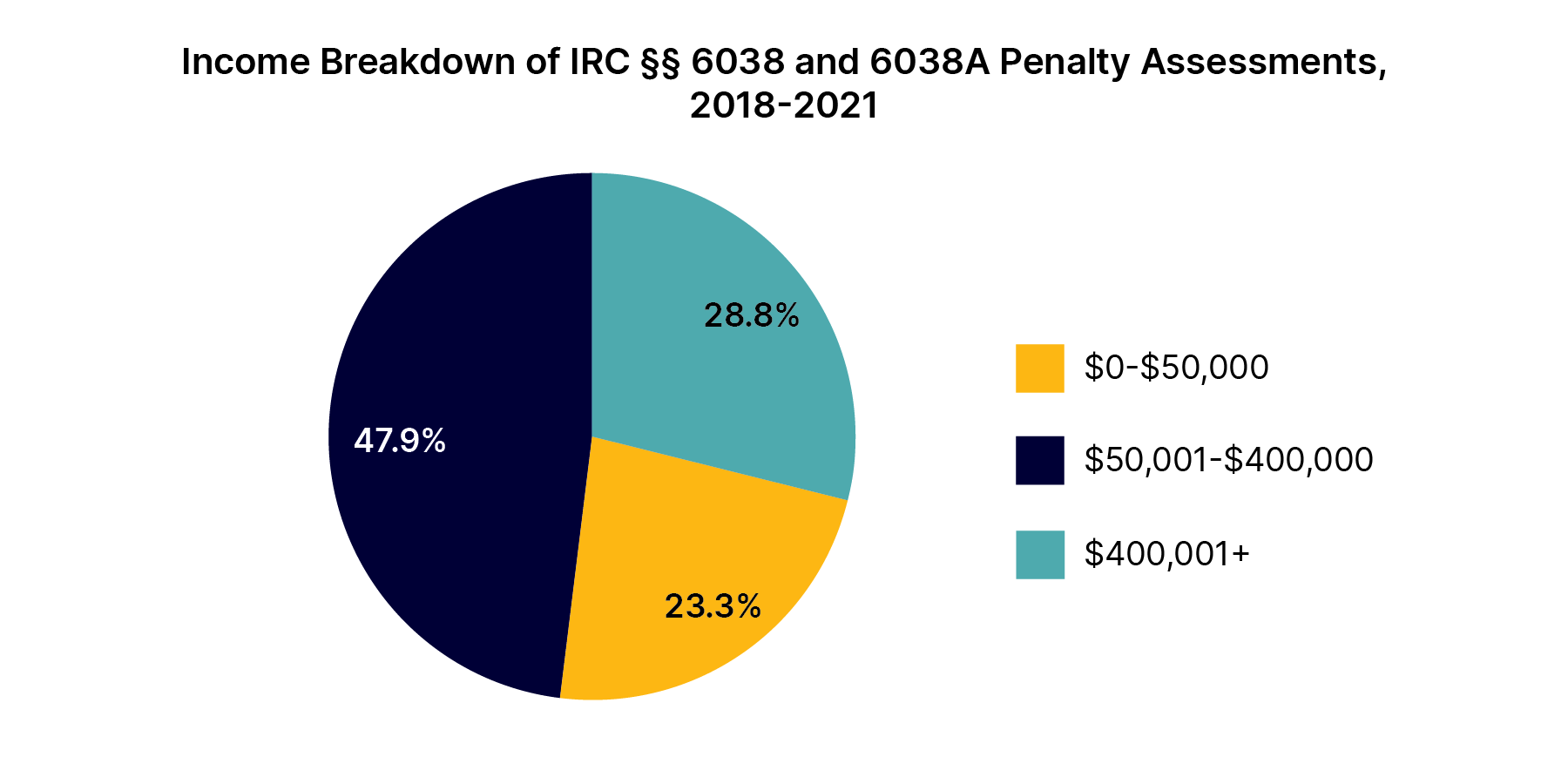

NTA Blog: International Information Return Penalties Impact a Broad Range of Taxpayers

August 24, 2023 – In a series of earlier blogs, I discussed some of the problematic aspects of the international information return (IIR) penalty regime. In Part 1, I advocated that, especially after the Tax Court’s decision in Farhy v. … Read More

TAS Tax Tip: Don’t Fall Victim to an Employee Retention Credit Scheme

August 17, 2023 – TAS Tax Tip: Don’t Fall Victim to an Employee Retention Credit Scheme Aggressive marketers and scammers have their targets set on the Employee Retention Credit (ERC). You may have seen television commercials or received emails promising … Read More

NTA Blog: EITC Audits: What You Need to Know

August 17, 2023 – TAS continues to advocate for legislation that would restructure the EITC to make it simpler for taxpayers. Despite the challenges involved, I encourage all taxpayers undergoing an EITC audit to fully participate in the EITC audit … Read More

NTA Blog: Attention Tax Professionals: Check Your Tax Pro Account

August 14, 2023 – Do you have a Tax Pro Account? If not, you should. With the recent improvements and additional functionality coming in the next year, the Tax Pro Account will finally start to provide tax professionals with online … Read More

IRS halts most unannounced collection employee visits to taxpayers

August 11, 2023 – Effective July 24, most unannounced visits by revenue officers will stop. IRS halts most unannounced collection employee visits to taxpayers On July 24, the IRS announced that it will immediately end most unannounced revenue officer (RO) … Read More

National Taxpayer Advocate Joins Treasury Secretary and IRS Commissioner for Launch of Paperless Processing Initiative

August 3, 2023 – National Taxpayer Advocate Joins Treasury Secretary and IRS Commissioner for Launch of Paperless Processing Initiative National Taxpayer Advocate Erin M. Collins joined Treasury Secretary Janet Yellen and IRS Commissioner Danny Werfel at the IRS facility in McLean, … Read More