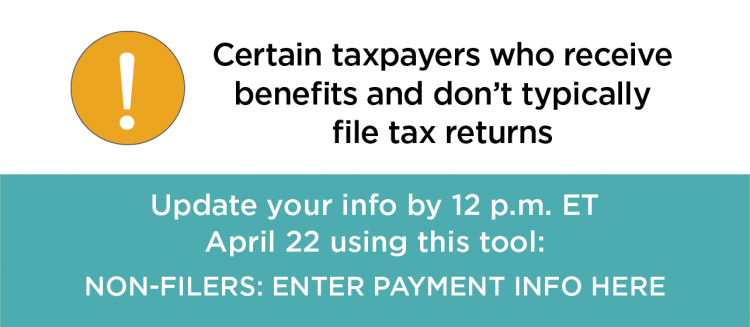

This is a special alert for benefit recipients who didn’t file a tax return in 2018 or 2019 and have dependents, so you can quickly receive the full amount of your Economic Impact Payment.

Individuals receiving Social Security retirement, survivor or disability benefits (SSDI), Railroad Retirement benefits, Supplemental Security Income (SSI), and Veterans Affairs beneficiaries need to provide the IRS more information if they didn’t file a tax return in 2018 or 2019 and have dependents who are qualifying children. Those individuals must use the Non-Filers: Enter Payment Info Here tool, by noon, Eastern time, on Wednesday April 22, 2020 to ensure they receive $500 per eligible child in addition to their automatic payment of $1,200.

See the Internal Revenue Service’s announcement for details.

Source: taxpayeradvocate.irs.gov

Leave a Reply