The post National Taxpayer Advocate issues mid-year report to Congress; expresses concern about continued refund delays and poor taxpayer service appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

Author Archives: Bruno Moura

National Taxpayer Advocate to Testify with IRS Commissioner at Government Operations Subcommittee Hearing

4/20/2022 – On Thursday, April 21 at 10 a.m. Eastern Time, National Taxpayer Advocate Erin M. Collins will testify in front of the U.S. House of Representatives Oversight and Reform Committee, Subcommittee on Government Operations. National Taxpayer Advocate to Testify … Read More

TAS Tax Tip: 2021 Tax return filing is as easy as 1-2-3

This year our best advice for faster tax return processing without encountering delays is as easy as our tips below. #1 – Verify your information is accurate. Check the accuracy of everything you enter on that tax return, not just … Read More

Wait to receive your W-2 form or other income statements to file your tax return

The post Wait to receive your W-2 form or other income statements to file your tax return appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

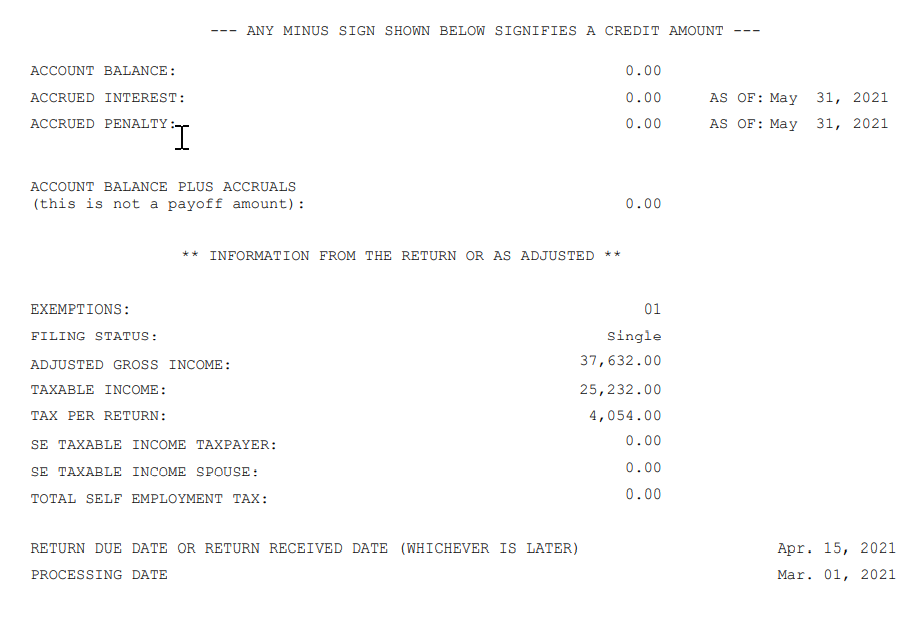

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part II

<!– Español –> Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Part I explained how transcripts are often used to validate income and tax … Read More

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part I

<!– Español –> Decoding IRS Transcripts and the New Transcript Format: Part I Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Transcripts are often … Read More

TAS’s Ability to Help With Delayed Refunds Is Limited

The post TAS’s Ability to Help With Delayed Refunds Is Limited appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

Blog de NTA: Defensora Nacional del Contribuyente publica el Informe Anual 2020 al Congreso

The post Blog de NTA: Defensora Nacional del Contribuyente publica el Informe Anual 2020 al Congreso appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

National Taxpayer Advocate Releases Annual Report to Congress and “Purple Book”

The post National Taxpayer Advocate Releases Annual Report to Congress and “Purple Book” appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

Don’t Let Delays in IRS Processing Impact Your Advance Payments of the Premium Tax Credit to Help Pay for Your Health Insurance

The post Don’t Let Delays in IRS Processing Impact Your Advance Payments of the Premium Tax Credit to Help Pay for Your Health Insurance appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov