The IRS will send a notice or a letter for any number of reasons. It may be about a specific issue on your federal tax return or account, explain changes to your account, ask for more information, or request a … Read More

Author Archives: Stephen Rea

The Tax Lawyer journal features article by TAS Attorney Advisor

An article written by a Taxpayer Advocate Service Attorney Advisor is featured in the Spring 2019 issue of The Tax Lawyer, a tax law journal published quarterly by the American Bar Association. What’s Wrong with Strict Liability and Nonmonetary Penalties? … Read More

NTA Blog: Why We Should Repeal the Flora Rule or Find Another Way to Give Taxpayers Who Cannot Pay the Same Access to Judicial Review as Those Who Can (Part 2 of 3)

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog In last week’s blog, I discussed how the … Read More

National Taxpayer Advocate Congressional Testimony

NTA Testimony window.location.href = “https://taxpayeradvocate.irs.gov/about/our-leadership/testimony”; Source: taxpayeradvocate.irs.gov

TAS wants to hear from Practitioners at the 2019 Tax Forums – Join our Focus Groups

Each year, the IRS sponsors the Nationwide Tax Forums, a three-day series of tax education and networking conferences for tax professionals in cities around the country. Taxpayer Advocate Service (TAS) holds focus groups at the forums because it is interested in … Read More

NTA Blog: Why We Should Repeal the Flora Rule or Find Another Way to Give Taxpayers Who Cannot Pay the Same Access to Judicial Review as Those Who Can (Part 1 of 3)

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog Taxpayers have the right to appeal a decision … Read More

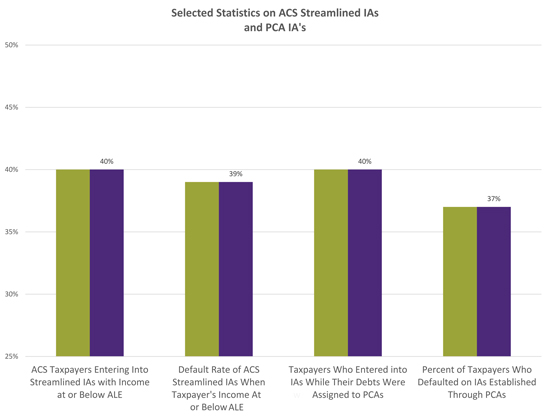

NTA Blog: The IRS is Not Doing Enough to Protect Taxpayers Facing Economic Hardship

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog The Taxpayer Bill of Rights (TBOR) grants taxpayers … Read More

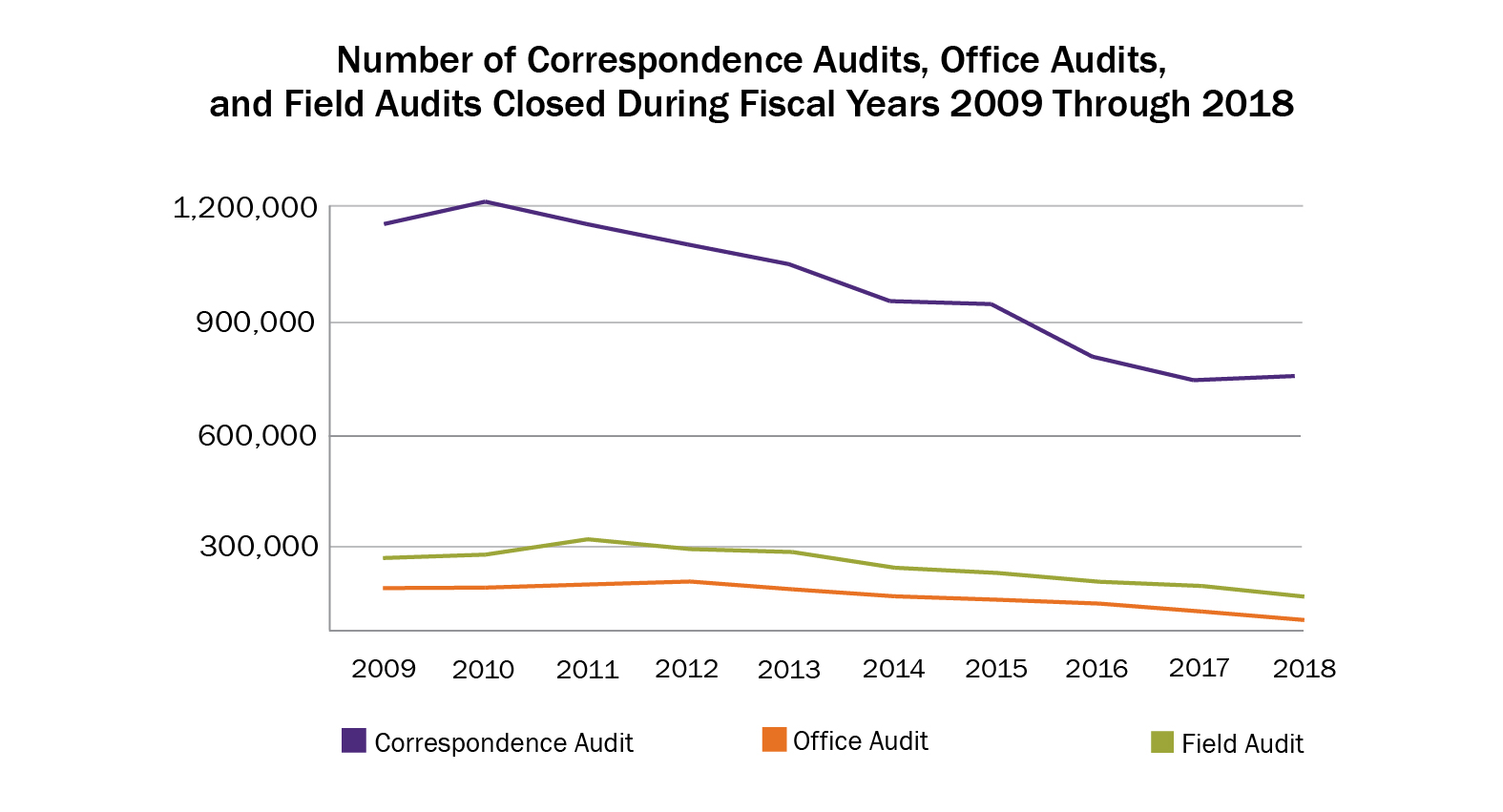

NTA Blog: IRS Examinations Continued – The IRS Should Promote Voluntary Compliance and Minimize Taxpayer Burden in the Selection and Conduct of Audits

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog In my recently released Annual Report to Congress, … Read More

Success Story: Through advocacy and perseverance, TAS helped relieve a taxpayer’s hardship

Every year, the Taxpayer Advocate Service (TAS) helps thousands of people with tax problems. This story is only one of many examples of how TAS helps resolve taxpayer’s tax issues. All personal details are removed to protect the taxpayer’s privacy. … Read More

NTA Blog: There is Still Time to Register for the International Taxpayer Rights Conference

Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog We are just weeks away from the 4th … Read More