September 28, 2023 – The IRS Nationwide Tax Forum was back in-person and in full swing this summer after three years of going virtual during the pandemic. At each of the five tax forums held across the country, I had … Read More

Author Archives: Toni Keeling

NTA Blog: Collection Part Two: End of the IRS Revenue Officer “Pop-In” Visit

September 11, 2023 – The IRS announced it is ending the practice of unannounced visits from its revenue officers. The policy change is due to the rise in tax scams and taxpayer confusion over verifying an IRS employee’s identity, leading … Read More

NTA Blog: Collection Part 1 – Do You Have an Outstanding Tax Due? Why Wait?

September 7, 2023 – In a March 2022 blog, I wrote about the IRS suspension of more than a dozen automated collection letters and notices associated with the filing of a tax return or payment of tax. The suspension was … Read More

NTA Blog: Reconsidering the IRS’s Approach to Supervisory Review

August 29, 2023 – Some penalties require supervisory approval before they can be assessed by the IRS. The applicable statute, however, is vague regarding the point at which this approval must occur. This statutory ambiguity has generated conflicting decisions among … Read More

NTA Blog: Where’s My Refund? Has Your Tax Return Been Flagged for Possible Identity Theft (IDT)?

August 22, 2023 – One persistent challenge the IRS continually deals with is preventing fraudulent refunds from being issued. Sadly, this phenomenon has become more and more common, as the number of refundable credits and their values continue to increase, … Read More

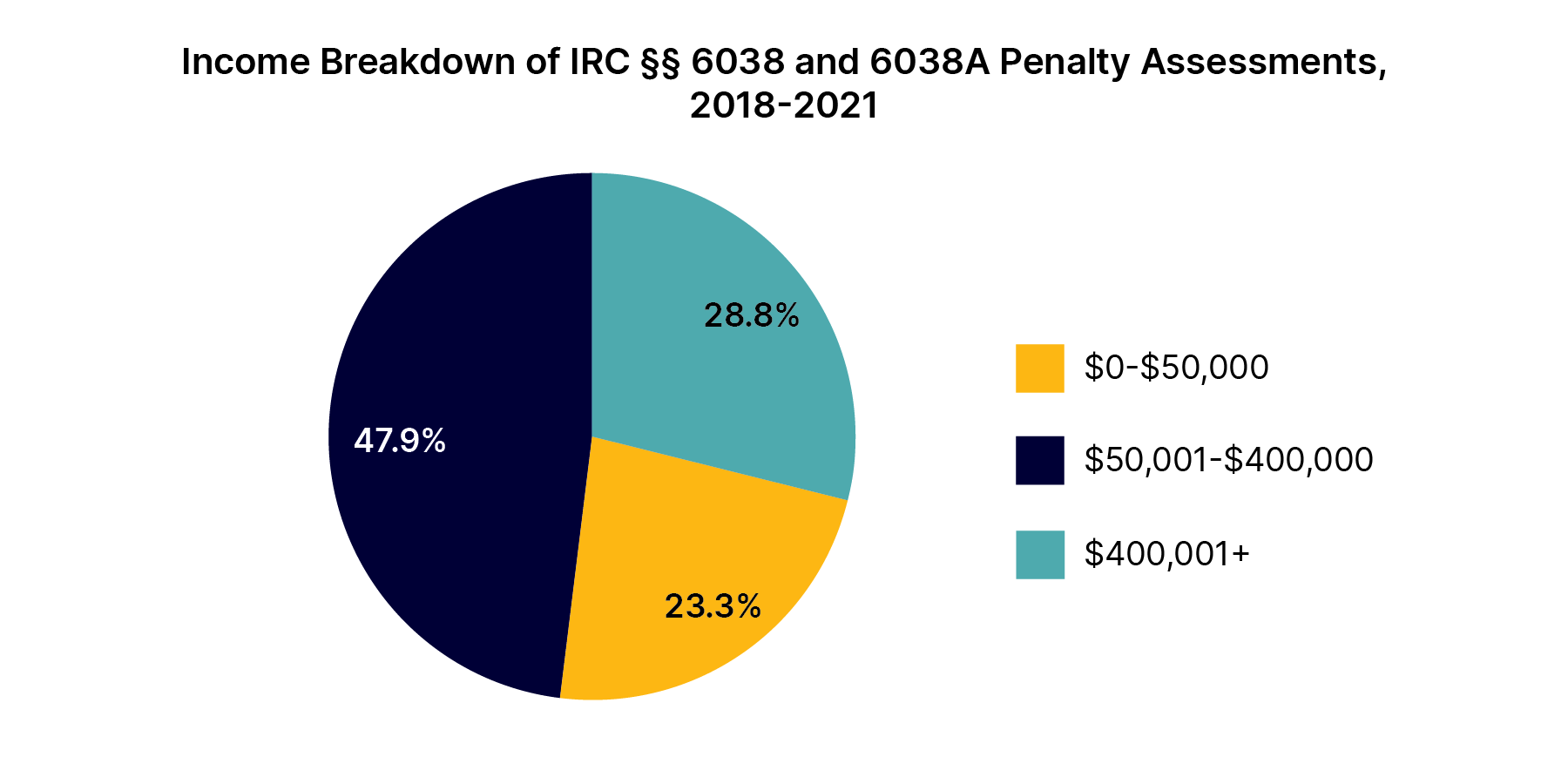

NTA Blog: International Information Return Penalties Impact a Broad Range of Taxpayers

August 24, 2023 – In a series of earlier blogs, I discussed some of the problematic aspects of the international information return (IIR) penalty regime. In Part 1, I advocated that, especially after the Tax Court’s decision in Farhy v. … Read More

NTA Blog: Attention Tax Professionals: Check Your Tax Pro Account

August 14, 2023 – Do you have a Tax Pro Account? If not, you should. With the recent improvements and additional functionality coming in the next year, the Tax Pro Account will finally start to provide tax professionals with online … Read More

NTA Blog: (Part 2) Disaster Relief: What the IRS giveth, the IRS taketh away. Or so it seems for disaster relief taxpayers until you get to page 4 of the collection notice

July 12, 2023 – As discussed in Part One, over one million taxpayers living in a disaster area filed their returns early with a balance due, expecting to make a timely payment by the postponed dates. Unfortunately, for taxpayers covered by … Read More

NTA Blog: (Part 1) Disaster Relief: What the IRS giveth, the IRS taketh away. Or so it seems for disaster relief taxpayers until you get to page 4 of the collection notice

July 11, 2023 – Imagine you live in a county that has been battered by storms or wildfires so severe that the federal government has included your county in a disaster declaration. Imagine that the IRS grants you an extra … Read More