NTA Blog: Minimum Competency Standards for Return Preparers Are Crucial Taxpayer Protections Congress Should Enact Legislation to Protect American Taxpayers Since 2002, TAS has been a strong proponent of legislation providing the IRS authority to establish minimum competency standards for … Read More

NTA Blog

NTA Blog: IRS Initiates New Favorable Offer In Compromise Policies

The post NTA Blog: IRS Initiates New Favorable Offer In Compromise Policies appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

NTA Blog: IRS Delays in Processing Amended Tax Returns Are Impacting TAS’s Ability to Assist Taxpayers

In a previous blog, I highlighted the impact of the IRS’s processing delays and the resulting increase in cases on TAS’s ability to serve taxpayers. Today, I want to provide information on limitations TAS is facing in assisting individual and … Read More

NTA Blog: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers? Part II: Help Is on the Way for Taxpayers Whose Payment Arrangements With Private Collection Agencies Were Terminated

NTA Blog: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers? Part II: Help Is on the Way for Taxpayers Whose Payment Arrangements With Private Collection Agencies Were Terminated In my October … Read More

NTA Blog: The IRS and Private Collection Agencies: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers?

October 13, 2021 NTA Blog: The IRS and Private Collection Agencies: Four Contracts Lapsed and Three New Ones Are in Place: What Does That Mean for Taxpayers? Background on IRS’s Private Collection Agencies In December 2015, Congress required the … Read More

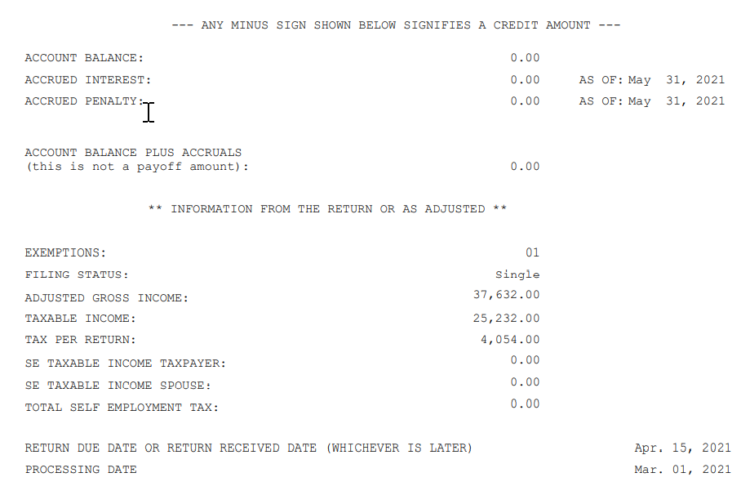

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part II

<!– Español –> Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Part I explained how transcripts are often used to validate income and tax … Read More

NTA Blog: Decoding IRS Transcripts and the New Transcript Format: Part I

<!– Español –> Decoding IRS Transcripts and the New Transcript Format: Part I Many individuals may not know they can request, receive, and review their tax records via a tax transcript from the IRS at no charge. Transcripts are often … Read More

Blog de la NTA: ¿Ha presentado recientemente una petición ante el Tribunal Tributario de los Estados Unidos?

Blog de la NTA: ¿Ha presentado recientemente una petición ante el Tribunal Tributario de los Estados Unidos? English El Tribunal Tributario de los Estados Unidos es un tribunal federal que el Congreso estableció para proporcionar un foro judicial donde los … Read More

NTA Blog: Bumps in the Road Sequel: Update on the Filing Season Challenges: Part II

NTA Blog: Bumps in the Road Sequel: Update on the Filing Season Challenges: Part II Even though the 2021 filing season officially ended on May 17, 2021, as discussed in Part I, the IRS has reduced its tax year (TY) … Read More

NTA Blog: Bumps in the Road Sequel: Update on the Filing Season Challenges: Part I

The post NTA Blog: Bumps in the Road Sequel: Update on the Filing Season Challenges: Part I appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov