August 22, 2023 – One persistent challenge the IRS continually deals with is preventing fraudulent refunds from being issued. Sadly, this phenomenon has become more and more common, as the number of refundable credits and their values continue to increase, … Read More

NTA Blog

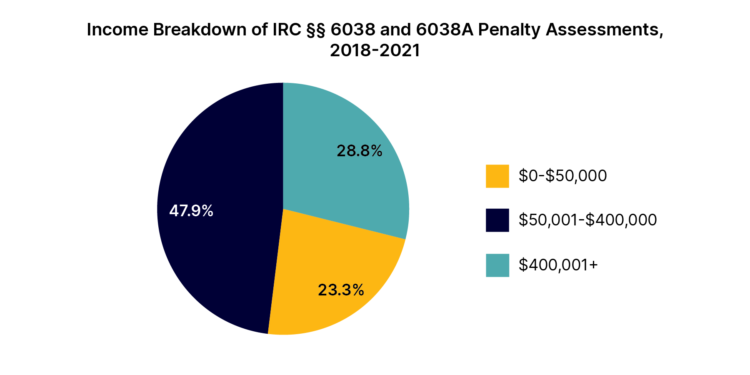

NTA Blog: International Information Return Penalties Impact a Broad Range of Taxpayers

August 24, 2023 – In a series of earlier blogs, I discussed some of the problematic aspects of the international information return (IIR) penalty regime. In Part 1, I advocated that, especially after the Tax Court’s decision in Farhy v. … Read More

NTA Blog: EITC Audits: What You Need to Know

August 17, 2023 – TAS continues to advocate for legislation that would restructure the EITC to make it simpler for taxpayers. Despite the challenges involved, I encourage all taxpayers undergoing an EITC audit to fully participate in the EITC audit … Read More

NTA Blog: Attention Tax Professionals: Check Your Tax Pro Account

August 14, 2023 – Do you have a Tax Pro Account? If not, you should. With the recent improvements and additional functionality coming in the next year, the Tax Pro Account will finally start to provide tax professionals with online … Read More

NTA Blog: (Part 2) Disaster Relief: What the IRS giveth, the IRS taketh away. Or so it seems for disaster relief taxpayers until you get to page 4 of the collection notice

July 12, 2023 – As discussed in Part One, over one million taxpayers living in a disaster area filed their returns early with a balance due, expecting to make a timely payment by the postponed dates. Unfortunately, for taxpayers covered by … Read More

NTA Blog: (Part 1) Disaster Relief: What the IRS giveth, the IRS taketh away. Or so it seems for disaster relief taxpayers until you get to page 4 of the collection notice

July 11, 2023 – Imagine you live in a county that has been battered by storms or wildfires so severe that the federal government has included your county in a disaster declaration. Imagine that the IRS grants you an extra … Read More

NTA Blog: Tax Court Moves Toward Greater Transparency With Expanded Online Access But Could Do More

June 13, 2023 – The post NTA Blog: Tax Court Moves Toward Greater Transparency With Expanded Online Access But Could Do More appeared first on Taxpayer Advocate Service. Source: taxpayeradvocate.irs.gov

NTA Blog: Refund Statutes and the Lookback Rule Make Taxpayer and Tax Professionals’ Eyes Glaze Over

May 4, 2023 – As I recently stated in my February 27, 2023, blog (NTA Blog: Lookback Rule: The IRS Fixes the Refund Trap for the Unwary), the IRS issued Notice 2023-21 providing taxpayers a longer lookback period when determining … Read More

NTA Blog: Foreign Information Penalties: Part Three: Keeping a Watchful Eye on the FBAR Guard Dog

May 1, 2023 -This is part 3 of my blog series addressing international reporting requirements. Part 1 addressed the U.S. Tax Court’s decision in Farhy v. Commissioner and the need to make Chapter 61 international information return penalties subject to … Read More

NTA Blog: Chapter 61 Foreign Information Penalties: Part Two: Taxpayers and Tax Administration Need Finality, Which Requires Legislation

April 20, 2023 – Due process requires that matters be resolved according to established rules and principles and that taxpayers be treated fairly. The international information return (IIR) penalty regime under IRC Chapter 61, Subchapter A, Part III, Subpart A … Read More