Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog.

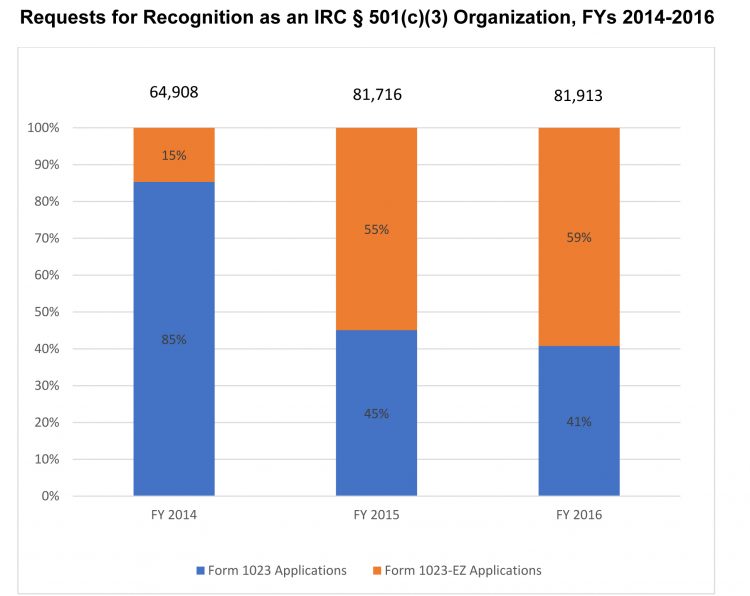

The IRS introduced Form 1023-EZ, Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code, in July 2014. IRS records show that between August and December of 2014, the IRS approved about 15,000 Form 1023-EZ applications. The volume of approved 1023-EZ applications increased to more than 42,000 in 2015, more than 47,000 in 2016, and more than 49,000 in 2017. Organizations with total assets up to $250,000 and those expecting annual gross receipts up to $50,000 are eligible to use Form 1023-EZ. Most applications for recognition as an IRC § 501(c)(3) organization are submitted on Form 1023-EZ, and the IRS approves almost all Form 1023-EZ applications. The growth in applications for exempt status from fiscal years 2014-2016 is shown below.

In FY 2017, Form 1023-EZ submissions continued to outstrip Form 1023 applications – Form 1023-EZ applications comprised 65 percent of total applications received for exemption under IRC § 501(c)(3).

In my 2015, 2016, and 2017 Annual Reports to Congress (including a study in volume 2 of the 2015 report) I described the unacceptable frequency with which the IRS approves a Form 1023-EZ submitted by an organization that does not qualify for IRC § 501(c)(3) status as a matter of law. I based that conclusion on a review of successful Form 1023-EZ applicants’ articles of incorporation.

In 2015, 2016, and 2017, my research staff selected from the population of successful Form 1023-EZ applicants a representative sample of corporations from 20 states that make articles of incorporation available online at no charge. For the 2017 report, the sample was expanded to include representative cases from four additional states that began posting articles of incorporation online at no charge. A TAS team then reviewed the articles of incorporation of each organization in the sample to ascertain whether the articles contained purpose and dissolution clauses as required by the applicable Treasury regulations. The reviews showed that the IRS erroneously approved Form 1023-EZ applications between 26 and 42 percent of the time (46 percent of the time when the additional four states are included), as shown by the chart below.

If an organization incorrectly attested on Form 1023-EZ that it qualified as an IRC § 501(c)(3) organization, it may also have been noncompliant with respect to its annual reporting obligations. Once recognized as exempt, organizations are generally required to file annual information returns on Form 990, but under applicable Treasury regulations and IRS procedures, some small organizations (those that normally have annual gross receipts of not more than $50,000) need only submit Form 990-N, e Postcard each year. A return or an e-Postcard is due on or before the 15th day of the fifth calendar month following the close of the organization’s accounting period (i.e., on May 15, for a calendar year organization). When an organization fails to file an information return or e-Postcard for three consecutive years, its exempt status is automatically revoked, under IRC § 6033(j)(1). Thus, a calendar year organization that applied for and received exempt status in 2014 but did not file annual returns or notices thereafter would lose its exempt status in May of 2017. The automatic revocation provisions were enacted by the Pension Protection Act of 2006, long before the IRS adopted Form 1023-EZ.

According to the IRS’s Select Check database, the exempt status of about a third of the 15,000 organizations whose Form 1023-EZ applications were approved in 2014 has been automatically revoked. Because the volume of approved Form 1023-EZ applications increased in 2015 and 2016, I expect the volume of automatic revocations to increase in the coming years. Some might welcome these automatic revocations as a partial solution to the problem of erroneously granting exempt status in the first place. I have a different perspective.

For one thing, automatic revocation of exempt status may prompt an organization to dissolve, which may in turn raise concern about how the organization disposes of its assets. For example, in the 2015 TAS study of corporations whose Forms 1023-EZ were approved, 23 percent of the organizations in the representative sample did not have adequate dissolution clauses. Among them was an organization whose articles of incorporation contained a dissolution clause that provided in its entirety: “Assets will be distributed to registrant of entity [individual taxpayer’s name], if this nonprofit dissolves.” This organization’s articles of incorporation had no purpose clause at all; the organization did not qualify for exempt status, by law, regardless of the IRS’s approval. But even if its exempt status is automatically revoked, thereby “solving” the problem of an erroneous Form 1023-EZ approval, there may be no accountability for assets the organization accumulated during the years it held exempt status.

More importantly, I do not believe it is sound tax administration to view automatic revocations as mitigating a problem the IRS created by approving – almost automatically – applications for IRC § 501(c)(3) status. Taxpayers, both those seeking exempt status and those who subsidize that status, would be better served by the IRS making actual determinations on the basis of documents that demonstrate an applicant understands the basic requirements for obtaining and maintaining tax exempt status.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate is appointed by the Secretary of the Treasury and reports to the Commissioner of Internal Revenue. However, the National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget.

Source: taxpayeradvocate.irs.gov

Leave a Reply