Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog.

In this week’s blog, I highlight my concerns with the IRS Free File program, which I also discussed in my 2018 Annual Report to Congress and my recent testimony before the House Ways and Means Subcommittee on Oversight. I also describe my personal experience using Free Fillable Forms and make some recommendations for improving these products. This is a bit of a long post, but the topic requires some background discussion to understand how we got to where we are today.

Background

The IRS Restructuring and Reform Act of 1998 directed the IRS to set a goal of increasing the e-file rate to at least 80 percent by 2007. In 2002, the IRS entered into an agreement with a consortium of tax software companies, known as Free File, Inc. (FFI), under which the companies would provide free tax return software to a certain percentage of U.S. taxpayers, and in exchange, the IRS would not compete with these companies by providing its own software to taxpayers. The agreement has been renewed at regular intervals, and for at least the past decade, the agreement has provided that the consortium would make free tax return software available for 70 percent of taxpayers (currently, about 105 million), particularly focusing on increasing access for economically disadvantaged and underserved communities, as measured by adjusted gross income.

The program provides two return preparation options for taxpayers that can be accessed on the IRS.gov homepage:

- Free File Software: options for online software to guide taxpayers through return preparation available to taxpayers with incomes less than $66,000; and

- Free File Fillable Forms: an electronic version of IRS paper forms available to all taxpayers, regardless of income.

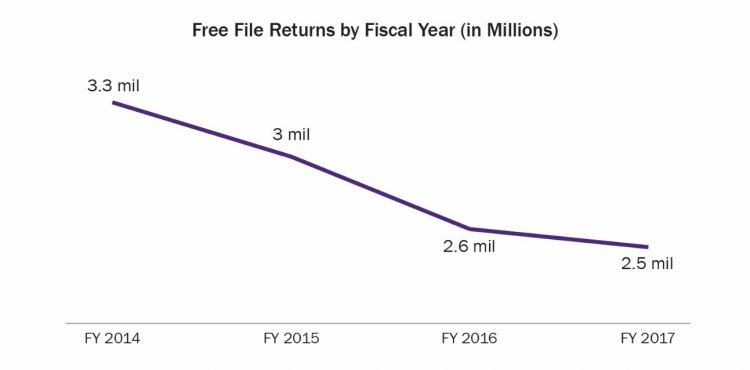

The Services Provided by Free File, Inc. Fail to Meet the Needs of Taxpayers, and Use of the Program Continues to Decline

While e-filing has increased by over 180 percent since 2002, use of the Free File program has not. In 2018, individual taxpayers filed more than 154 million tax returns. Yet fewer than 2.5 million of those returns, or 1.6 percent, were filed using Free File software (this calculation does not include the number of taxpayers who used Free Fillable Forms to file their tax returns). Thus, about 68 percent of all taxpayers were eligible to use Free File software but did not do so—frequently paying to purchase the same or comparable software instead. In fact, use of the Free File program has decreased since 2014—meaning that taxpayers who used Free File in previous years chose a different option to file their returns in the following year.

.jpg)

In comparison, paid preparers filed almost 78.6 million tax returns electronically in tax year 2017. Over 3.5 million returns were prepared through Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs, a higher number than prepared by FFI despite the fact that taxpayers must expend more time and resources to go to one of these sites.

In addition, data on repeat usage suggest Free File users are widely dissatisfied with the program. Among taxpayers who used Free File software in 2017, the majority (51 percent) did not use Free File software again in 2018.

Why do so few taxpayers use Free File, instead often opting to pay for the same or comparable software? Are taxpayers unaware of these services or unwilling to use them? In my 2018 Annual Report to Congress, I identified the Free File program as one of the Most Serious Problems faced by taxpayers. I am concerned that the IRS devotes minimal resources to overseeing and testing this program, to understanding why so few eligible taxpayers are using it, and to considering how the service offerings could be improved.

I identified the following specific shortcomings:

- The lack of a marketing budget for the Free File program. The IRS does not promote or advertise Free File, outside of placing it on its website.

- The absence of an effective evaluation process to understand the experience of taxpayers who use the program and whether the terms of the IRS Free File Memorandum of Understanding (MOU) are being met.

- Age restrictions that sharply curtail the number of Free File options available to older taxpayers. Only three of the current 12 Free File providers offer services to taxpayers of all ages, and five have age limitations that start before the age of 60.

- The absence of any Free File options for English as a Second Language (ESL) taxpayers during filing season 2018. A recent TAS study showed that because of language barriers and less education, Spanish-speaking taxpayers may be especially vulnerable to unscrupulous return preparers who promote high-interest loans and charge high fees—which makes the need for tax return preparation assistance, vetted by the IRS, even greater for members of this group.

My own personal experience with Free File is instructive. As most readers know, for almost two decades, I have advocated that the IRS create an electronic analogue to the paper Form 1040, instructions and publications so taxpayers can electronically prepare and file their tax returns for free. I’ve recommended the product do basic math and transfer numbers from one form to another (thus avoiding computation and clerical errors), and link to specific line instructions and publications, including fillable worksheets. The Free Fillable Forms product on Free File satisfies most of those requirements, and I have used that product to prepare my own tax return since its inception.

Free Fillable Forms is not without its flaws. Each year I discover glitches, which I convey to the IRS, and the 2018 filing season was no exception. As I entered my information into the main Form 1040, I discovered that the links to the instructions did not function properly. Thus, I had to log back and forth between the IRS.gov website to read the 1040 instructions and look up my tax rate, and the Free Fillable Forms site to enter the information into the electronic 1040. When I hit the “Save” button at the top of the screen, I was not provided the option of saving the return to my personal computer. When I attempted to print out my tax return, I was not able to print out the entire return. Instead, I could print out the individual schedules one-by-one, but I could not print out the 1040.

I thought about just going to the IRS website and printing out a blank 1040 and transcribing the numbers from the Free Fillable form 1040, so I could have a complete copy of my return. But that might look suspect—to have a handwritten 1040 with printed schedules—if I were to submit my return for a loan application or some other purpose. So, I went back to IRS.gov, printed off a Form 1040 on paper, filled in the lines on the paper Form 1040 with the information from Free Fillable Forms, then went back to IRS.gov and transcribed the numbers from the paper 1040 onto the “fillable-pdf” Form 1040, and, finally, printed off the “fillable-pdf” Form 1040 and put it together with the other schedules I had printed from Free Fillable Forms.

Oof. Is it any wonder usage is so low? Not everyone is going to be as stubborn as the National Taxpayer Advocate; most would have abandoned the product when they learned they couldn’t link to instructions.

Testing by TAS found that several software providers on Free File have limitations in their navigational features and ability to help taxpayers correctly complete their returns, resulting in poor service quality. In addition, cross-marketing and advertising of other services on Free File software platforms can confuse and frustrate taxpayers, probably contributing to the low repeat-usage rate. Because Free File software programs are accessed through IRS.gov, taxpayers may be under the false impression that the IRS endorses the Free File products available there, and thus a poor experience with Free File may reflect poorly on the IRS and can erode taxpayers’ trust in fair tax administration.

Can the Program Be Improved?

Preliminary data for the 2019 filing season show that, as of March 8, 2019, Free File usage slightly increased by five percent, compared to the same time period in 2018. The increase may be attributed to the following new features:

- If a taxpayer using Free File visits a member’s website and finds he or she doesn’t qualify to use that member’s Free File product, the taxpayer will be able to more easily return to the main IRS Free File page and select another product.

- If a taxpayer who used Free File last year visits the Free File member’s website this year, the first option the taxpayer will see after logging into his or her account will be the Free File option (as opposed to a paid product).

- Taxpayers who used Free File last year will receive emails welcoming them back to the Free File service.

It should be emphasized that a five percent increase in the use of Free File software, while positive, amounts to only about 124,000 additional Free File returns. Put differently, it would have caused the percentage of taxpayers using Free File software last year to increase from 1.6 percent of all filed returns to 1.7 percent of all filed returns.

To achieve a discernible increase in Free File participation, I recommend the IRS take the following steps:

- Develop actionable goals for the Free File program before entering into a new agreement that, among other things, aim to substantially increase taxpayer usage and increase the percentage of taxpayers who continue to use the program from year to year.

- Create measures evaluating taxpayer satisfaction with the Free File program and test each return preparation software’s ability to complete various forms, schedules, and deductions.

- Provide Free File Fillable Forms and software options for ESL taxpayers.

- Prepare an advertising and outreach plan to make taxpayers, particularly in underserved communities, aware of the Free File program.

However, if the IRS continues to show no appetite for monitoring and overseeing, including testing, its Free File offerings, I recommend it terminate that aspect of the program and instead focus on improving and promoting Free Fillable Forms. At any rate, the IRS should improve Free Fillable Forms by:

- Linking from a specific line on the 1040 to the instructions for that line (rather than to the beginning of the instruction, making the user page through scores of pages);

- Linking from IRS form instructions to IRS publications wherever IRS forms reference IRS publications;

- Creating versions available in other languages, including Spanish;

- Ensuring the program is compatible with major printers;

- Enabling users to save a copy of their return to their personal electronic devices; and

- Providing a dedicated email address where taxpayers (such as the National Taxpayer Advocate) can get help when experiencing technology glitches.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate is appointed by the Secretary of the Treasury and reports to the Commissioner of Internal Revenue. However, the National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget.

Source: taxpayeradvocate.irs.gov

Leave a Reply