Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog

In my recently released Annual Report to Congress, I discussed the need to evaluate the impact of IRS audits on voluntary compliance. Last week’s blog discussed some of the strengths and weaknesses of the three types of traditional IRS audits: correspondence audit, office audit and field audit. In this week’s blog, I will discuss some of the factors that influence voluntary compliance.

What Factors Influence Voluntary Compliance?

Traditional voluntary compliance has focused on deterrence theory. However, social science research indicates that the deterrence theory accounts for only a portion of the actual compliance rates and, that social norms, personal values, and attitudes may have a larger impact on taxpayers’ compliance decisions. Studies have shown that to ensure a high level of voluntary tax compliance, taxpayers must have faith and trust in the fairness of the tax system. In this year’s report, I include a research study in Volume II that explores the influence of tax audits on taxpayers’ attitudes and perceptions. Overall, taxpayers in the study who experienced audits reported higher levels of fear, anger, threat, and caution when thinking about the IRS and felt less protected by the IRS. Taxpayers who experienced correspondence exams experienced a lower level of perceived justice compared to those who underwent office and field exams. The study also found that taxpayers who experienced an audit that resulted in a refund of tax perceived the IRS with less trust after the conclusion of the audit. These findings suggest that when selecting returns and evaluating audit cases, the IRS should research and consider how the audits build taxpayer trust and affect future voluntary compliance.

What Is the Impact of Traditional IRS Audits on Voluntary Compliance?

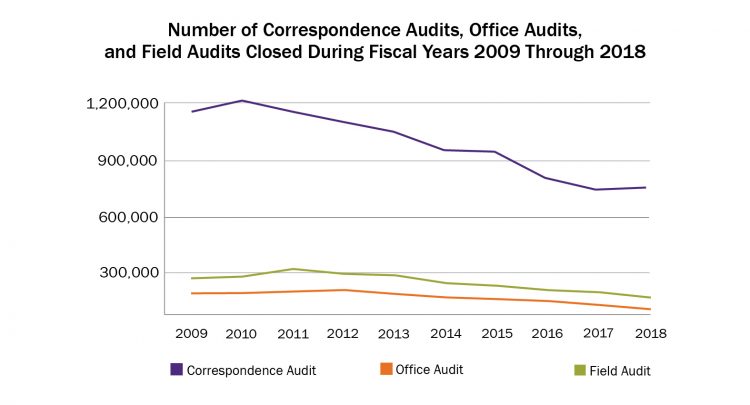

In the three Most Serious Problems in my 2018 report (here, here and here), I expressed concerns that IRS examinations fail to increase future voluntary compliance, do not measure voluntary compliance in terms of taxpayers’ positive attitudes towards the IRS and educating taxpayers, and place undue burdens on taxpayers. The IRS’s traditional audit program has been greatly reduced over the last ten years from a total of nearly 1.75 million audits in fiscal year (FY) 2010 to about 970,000 in FY 2018, as shown in the figure below.

For this reason, it is even more critical that the IRS focus on increasing voluntary compliance with the audits that it does conduct. An examination is primarily an education vehicle, so the taxpayer learns the rules, corrects mistakes, and can comply in the future. In fact, the IRS gains about twice as much from the long-term effects of an audit than it does from the actual audit itself. Yet, a significant number of correspondence audits—about 42 percent in FY 2018—were closed with no personal contact. As a result, the IRS misses opportunities to educate the taxpayer about complicated rules and procedures, and complicated fact situations, or both, as in the case of the Earned Income Tax Credit (EITC).

The IRS does not know whether its field exams are promoting voluntary compliance because it does not have a measure to track future filing compliance post-audit. Instead, the IRS focuses primarily on the bottom line and the direct effects of a specific audit—measuring closures, cycle time, employee satisfaction, and quality scores.

The IRS may also be selecting the wrong taxpayers and issues for field audit, given declining resources and high no-change rates—averaging 23 percent for Small Business/Self-Employeed (SB/SE) and 32 percent for Large Business and International (LB&I) field audits in FYs 2010-2018. Research shows that audits proposing no additional tax (“no change” audits) result in greater future noncompliance: a recent study found Schedule C taxpayers reduced their reported income in the three years after a no-change audit by about 37 percent.

The face-to-face experience in office exams benefits both the taxpayer and the IRS—the taxpayer can, in real time, ask questions and explain his or her position to the IRS, and the IRS employee can immediately see if the taxpayer understands the current examination, next steps to be taken, and how to comply in the future.

- The IRS could improve office audits by tracking results of audits that are appealed by the taxpayer, educating taxpayers on future compliance by adding taxpayer education as a quality attribute, and increasing the number of tax compliance officers (TCOs) in more locations throughout the United States.

- Correspondence audits could be converted into virtual face-to-face audits through the use of webex technology, which has been successfully piloted by the Office of Appeals.

- SB/SE’s field auditors could improve the taxpayers’ audit experience by sharing and discussing the audit plan with taxpayers and affording them the opportunity to propose changes to the plan before it is final, notifying taxpayers of any consultations with specialists, and giving them the opportunity to discuss with the specialist any technical conclusions.

The recommendations provided in my annual report can guide the IRS toward improving taxpayers’ audit experiences, and developing measures of an audit’s impact on future compliance.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate is appointed by the Secretary of the Treasury and reports to the Commissioner of Internal Revenue. However, the National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget.

Source: taxpayeradvocate.irs.gov

Leave a Reply