Subscribe to the NTA’s Blog and receive updates on the latest blog posts from National Taxpayer Advocate Nina E. Olson. Additional blogs from the National Taxpayer Advocate can be found at www.taxpayeradvocate.irs.gov/blog.

In last week’s blog, I discussed issues that arose during the 2018 filing season that contributed to the delay of taxpayers’ refunds when those taxpayers’ returns were selected into the non-IDT refund fraud program, including:

- timing issues with the matching of third-party information;

- how the system does not consider how third-party information would affect a taxpayer’s refund, and

- how the pre-refund wage verification program’s case management system, Electronic Fraud Detection System (EFDS), had to have third-party information uploaded manually instead of systemically.

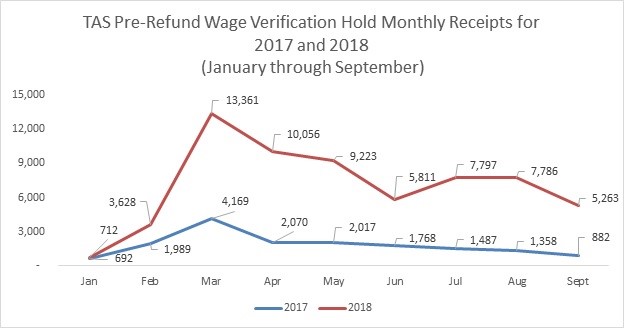

These issues resulted in an unprecedented increase in Taxpayer Advocate Service (TAS) case receipts in 2018 as more affected taxpayers sought TAS assistance.

As this graph illustrates, there were 63,637 TAS pre-refund wage verification refund hold case receipts from January 1, 2018 through September 30, 2018, compared to only 16,432 cases received over the same period the prior year – an increase of 287 percent!

In an effort to determine what was causing more taxpayers to seek TAS assistance, I began a series of conversations with the IRS regarding the non-IDT refund fraud program. As a result of these conversations, some of the issues discussed in last week’s blog were revealed and changes are being implemented to the 2019 filing season. Specifically, one of the filters that was added to the non-IDT refund fraud system last year and was responsible for a significant portion of TAS’s non-IDT refund fraud cases is being adjusted to search for third-party documentation daily instead of weekly, thereby addressing some of the timing issues previously discussed.

Additionally, the IRS has expressed interest in designing its systems to analyze how the consideration of third-party information will affect a taxpayer’s refund (i.e., if there is no change to the refund or the refund would actually increase, it would not be selected into the revenue protection program). Despite this progress, the problem with the pre-refund wage verification program’s case management system, EFDS, has not been resolved. More specifically, there is currently no fix that would allow EFDS to conduct most case processing systemically rather than manually. This supports my prior statements that it is time for EFDS to be fully retired and replaced with a more modern system which will benefit both taxpayers and the IRS.

Recall that with respect to the non-IDT refund fraud program, the false positive rate (FPR) is the percentage of legitimate returns selected by the IRS as potentially fraudulent divided by the total number of returns selected by the IRS as potentially fraudulent – in other words the percent of returns selected by the IRS ultimately confirmed as good returns. The simple formula for the FPR is:

The number of legitimate returns selected/the total number of selected returns from the time of selection.

So, if the IRS selected 100 returns in total, and of those 100 returns, 80 were legitimate, the FPR would be 80 percent.

On the other hand, the operational performance rate (OPR) is the false positive rate discounting those returns the IRS confirmed as legitimate returns within two weeks of selection (i.e., no more than four weeks from filing, counting the two weeks the IRS has to decide if the return should be selected as potentially fraudulent). Specifically, the OPR retains the same denominator as the FPR (the number of returns selected by the IRS), but the numerator is decreased by the number of returns that the IRS clears as legitimate, within two weeks of selection.

Now, continuing with our example above, the IRS’s current formula works as follows: 100 selected returns, with 80 returns determined to be legitimate (FPR). Twenty of these 80 legitimate returns were resolved within two weeks of selection (4 weeks total). Thus, the OPR is 60 percent [(80-20)/100 = 60%].

But the IRS’s OPR really isn’t an accurate reflection of the false positive rate for returns held more than two weeks after selection. Because the IRS uses as the denominator of the ratio the total number of returns it selected, it understates the false positive rate for those returns held more than 4 weeks.

To really understand both the taxpayer’s experience and the operation of Return Review Program’s filters and models, we need some additional information. For example, we also need a measure of how many returns are resolved in the 4 week period (2 week identifying plus 2 week resolution). That tells us whether the IRS is quickly resolving these issues so they don’t create unnecessary taxpayer burden, and also cause unnecessary phone calls to the IRS or TAS cases to be created.

And then we need a measure of the false positive rate (we could call it Operational FPR) – which is the ratio of the legitimate returns resolved after the 4 week period in the numerator and the number of returns left after the 4 week period in the denominator. So, working with our example, the IRS selected 100 returns, and it determined 80 were legitimate. Twenty of the 80 legitimate returns were resolved within two weeks of selection. That means the Operational FPR would be 75 percent [(80 – 20)/(100 – 20) = 75%].

With these 3 pieces of information, we can tell:

(1) Whether the IRS is quickly resolving the legitimate returns on the front end; or

(2) Whether the IRS is not quickly resolving the legitimate returns on the front end but rather has very high number of legitimate returns that have slipped through the 4 week period and thus are creating both taxpayer and IRS burden.

Either way, we can begin to identify if the problem is with over-inclusive filters or with under-staffing, or both. Also, if the IRS really is unwilling to focus on minimizing the overall FPR or the FPR for the initial 4 week period, then it needs to commit to huge staffing increases so it resolves most of the cases in the 4 week period and has a very very low Operational FPR – i.e., very few legitimate returns are held over 4 weeks, and what remain are highly likely to be inaccurate and even fraudulent.

The 81 percent FPR for January through October 24, 2018, is just plain unacceptable. Moreover, a 63 percent OPR is still too high. (And recall the OPR understates the FPR for this time period). As we noted in a Literature Review of Fraud Detection programs in the government and private sectors, a false positive rate of around 50 percent is generally accepted. The IRS has a lot of work to do to refine its filters, and I continue to believe it can do it, if it makes minimizing the FPR a priority. And with the rate of 81 or 63 percent, there is plenty of low-hanging fruit for improvement, without in any way jeopardizing revenue protection.

In regard to the IDT refund fraud program, as mentioned in last week’s blog, the IRS does not currently track the operational performance rate (OPR). Thus, the IRS does not track how many legitimate taxpayers selected into the IDT refund fraud program have their refunds delayed more than 4 weeks, and it most certainly isn’t aware of what issues are contributing to delays of these refunds. This is because the release of refunds is dependent on taxpayers authenticating their identify and it is more difficult for the IRS to identify what issues are preventing taxpayers from authenticating. Moving forward, I believe the IDT refund fraud program should also establish an OPR that can be monitored from year to year. (It is reasonable that the criteria that governs the IDT OPR may deviate from that of the non-IDT refund fraud program because of their different characteristics.)

Additionally, I think the IRS needs to conduct a study to determine what types of factors may be contributing to taxpayer’s delaying of authentication in IDT cases. This may provide insight into barriers taxpayers face when trying to authenticate, such as failing the over-the-phone authentication process, not being able to make an appointment at a Taxpayer Assistance Center (TAC) within a reasonable timeframe or being overwhelmed by having to deal with other issues caused by identity theft. The IRS should also closely monitor a new method of authenticating that is being implemented for the 2019 filing season, which is online authentication. It should keep close tabs on what types of issues taxpayers may encounter when attempting to authenticate online, and if they prefer one method of authentication over another (i.e., over the phone, in person, or online). Until the IRS conducts this necessary research, it is hard to know what issues are impacting taxpayers when attempting to authenticate their identity and whether failure to authenticate is due to fraud or a legitimate taxpayer’s inability to navigate the process.

I fully expect that the IRS will further rely on automated systems to detect and prevent refund fraud in the future, and that more and more taxpayers will be affected by these programs. It is critical that the IRS ensures that the majority of taxpayers selected into these programs will have their refunds delayed only a short period of time. I think some of the steps the IRS is taking for the 2019 filing season will move the IRS closer to meeting this objective. Nevertheless, even as the IRS tries to minimize delays once a return is selected, I continue to have concerns about the high FPR and OPR for IRS fraud detection systems. I will discuss those concerns in greater detail in the 2018 Annual Report to Congress.

The views expressed in this blog are solely those of the National Taxpayer Advocate. The National Taxpayer Advocate is appointed by the Secretary of the Treasury and reports to the Commissioner of Internal Revenue. However, the National Taxpayer Advocate presents an independent taxpayer perspective that does not necessarily reflect the position of the IRS, the Treasury Department, or the Office of Management and Budget.

Source: taxpayeradvocate.irs.gov

Leave a Reply